The Netherlands occupies a unique position internationally when it comes to mortgages. Mortgage interest has long been tax-deductible for income tax purposes, which means that people who pay mortgage interest owe less income tax. This makes it possible for many people to buy a home.

Mortgage interest is now mainly tax-deductible if certain conditions are met, such as:

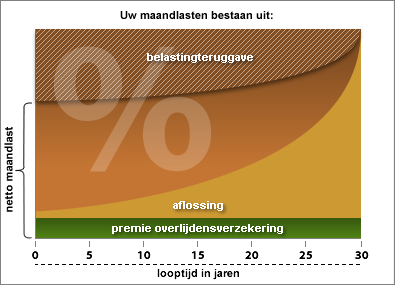

Of course, you simply pay interest on the mortgage you have taken out. In addition, you pay a small extra amount each year (or each month) as repayment. With an annuity, the total of that interest plus repayment remains the same. So you know exactly what to expect (provided that the mortgage interest rate does not change). Each year you repay a small portion of the mortgage debt. As a result, the amount of interest you owe also decreases each year. And that, in turn, creates room to repay a little more every year.

On top of that, the interest is tax-deductible. As a result, you pay less income tax: the “tax refund.” However, you will notice that this refund gradually becomes smaller over the years.

With a linear mortgage, you also pay interest on the outstanding mortgage debt. And here too, you repay the loan within a maximum of 30 years.

But with a linear mortgage, the repayment amount is significantly higher at the beginning. These are even fixed amounts. This makes the linear mortgage considerably more expensive than the annuity mortgage in the early years.

There were many of them, because a lot was allowed. Savings mortgages, investment mortgages, high–low constructions, premium deposits, mortgages with an investment-linked insurance policy, growth mortgages — all these old forms still exist. And in general, they continue (for now) to fall under the “old tax rules.”

Are you already a homeowner, moving house, and want to take your old mortgage with you? Then there are still plenty of options available for that.

But anyone buying their own home for the first time can, unfortunately, no longer make use of them.